The CFO for Entrepreneurs

Where Strong Financial Strategy Meets Innovative Solutions—Delivered With Integrity to Create Life-Changing Results

For over 15 years, we've stood by businesses and individuals navigating their most critical financial challenges. We're not just consultants—we're your financial partner who genuinely cares about your success, combining deep expertise in accounting, tax strategy, and business funding to create comprehensive solutions that move your finances forward.

Founded on the belief that everyone deserves access to expert financial guidance delivered with complete transparency, we've helped thousands transform financial stress into financial confidence. Our integrated approach addresses the complete picture of your financial life—because credit, taxes, business finances, and funding don't exist in isolation, and neither should your solutions.

Book Your Free Strategy Session

Your Financial Advocate

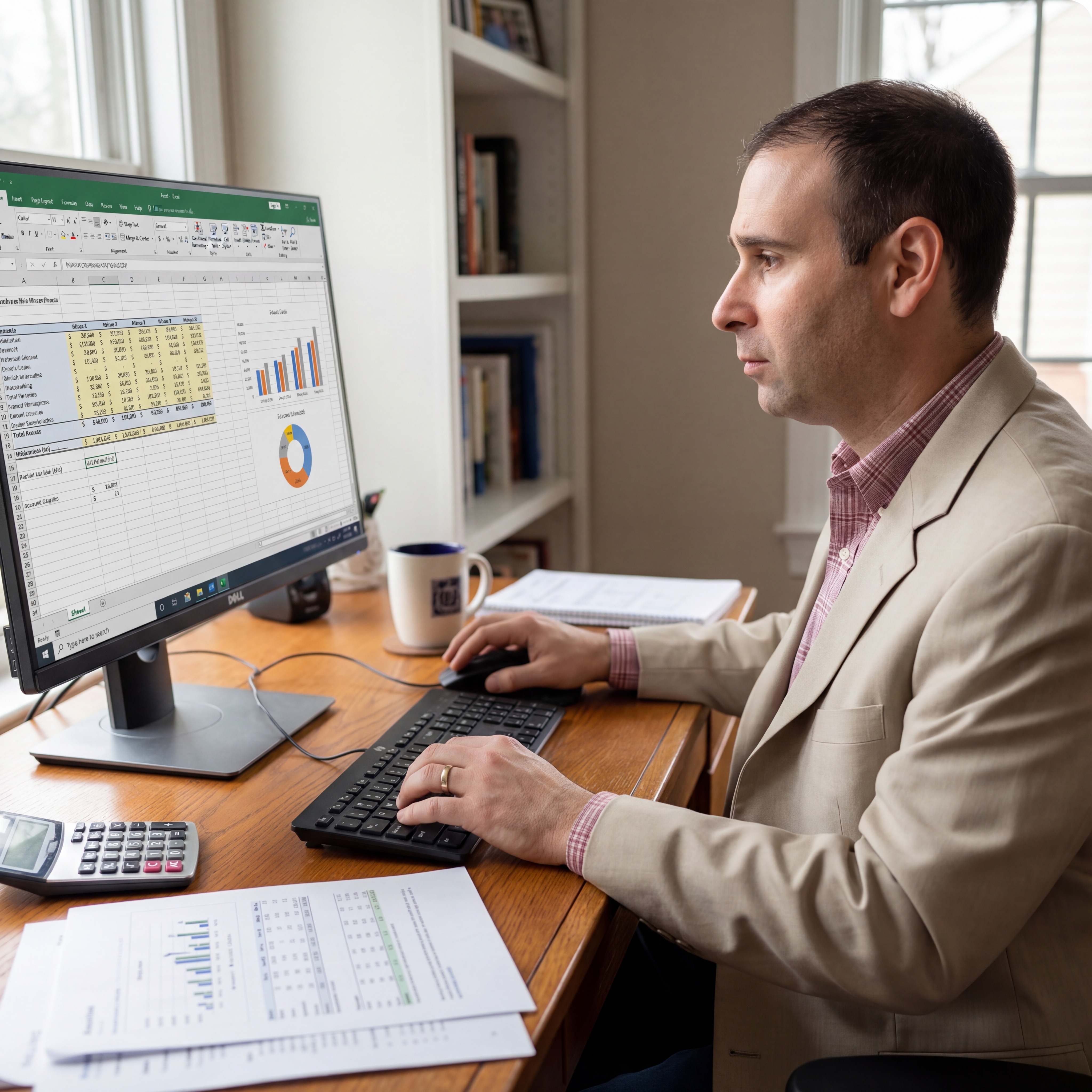

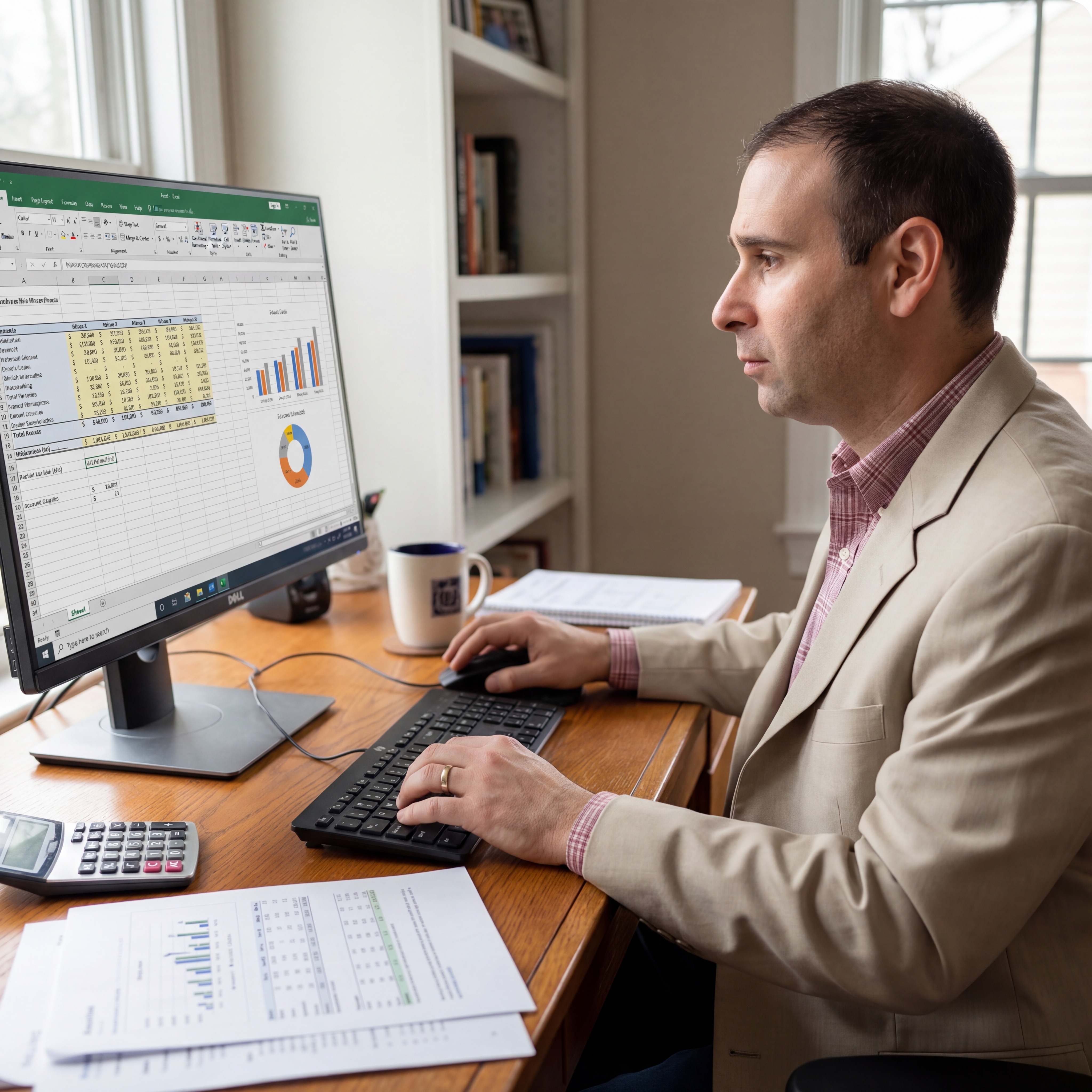

Steven Palmieri is a recognized financial consultant, entrepreneur, and credit expert celebrated for delivering comprehensive financial solutions that genuinely change lives. With extensive experience spanning business finance, tax strategy, credit optimization, and entrepreneurial growth, Steven has built his reputation on one fundamental principle: financial expertise means nothing without genuine care for client outcomes.

Steven created an integrated ecosystem designed to address every aspect of financial wellness—from small business CFO-level support and tax planning optimization services to professional bookkeeping, personal and business tax preparation, credit repair services for individuals, business debt settlement and restructuring, and high-level financial strategy for entrepreneurs. Drawing on his deep background in business finance solutions,

Steven empowers clients to improve their credit scores, reduce tax liabilities strategically, and achieve long-term financial stability through innovative financial strategies delivered with unwavering integrity. Whether guiding clients through cash flow analysis for small businesses, implementing consumer credit improvement strategies, or delivering strategic CFO services for entrepreneurs,

Steven consistently demonstrates his dedication to helping others optimize their accounting processes and secure brighter financial futures. Steven didn't build his business just to offer financial services—he built it to change how financial solutions are delivered, creating an experience where clients feel genuinely cared for, completely informed, and consistently protected.

This personal commitment drives everything at Stevens Palmieri, and when you work with our team, you're benefiting from the culture of care, transparency, and excellence Steven has built into every aspect of its operations. Steven's work has transformed thousands of businesses and individuals—because behind every client is a person who finally sleeps peacefully, an entrepreneur who secured funding for their dream, a family that escaped crushing tax debt, or an individual who rebuilt credit they thought was permanently damaged.

Our Core Values

The Principles That Guide Everything We Do

Our values aren't just words—they're the foundation of every decision, every recommendation, and every relationship we build.

Strong

Bulletproof Solutions That Withstand Any Challenge

We don't offer quick fixes. Everything that we do is designed to provide sustainable relief to our clients. When we optimize your tax structure, it delivers benefits for years. When we improve your credit, we build sustainable habits. When we secure funding, we ensure terms that support growth.

- Financial solutions that deliver results even when conditions change

- Robust solutions backed by proven methodologies

- Unwavering commitment to your long-term success

Integrity

Complete Transparency in Every Interaction

You deserve to understand exactly what we're doing, why we're doing it, what it costs, and what realistic outcomes can look like. This commitment to integrity means sometimes having difficult conversations—but this honesty builds the trust that creates lasting success.

- No hidden fees—ever

- No unrealistic promises—if we can't deliver something, we tell you immediately

- No confusing jargon without clear explanations

- Honest timelines that account for real-world complexities

- Recommendations that serve your interests

Innovative

Cutting-Edge Solutions That Accelerate Your Success

We respect time-tested principles while constantly seeking innovative approaches that deliver better, faster results. We invest in advanced technology and forward-thinking strategies. Innovation without expertise is reckless. Expertise without innovation is stagnation. We give you both.

- Financial analysis that identifies hidden opportunities

- Real-time dashboards providing 24/7 financial visibility

- Advanced tax modeling showing exactly how strategies impact outcomes

- Relationships with traditional banks and innovative fintech lenders

- Proprietary credit optimization processes that accelerate credit score improvements

Life-Changing

Transformations That Reshape Your Financial Future

We're here to create fundamental transformations that reshape financial trajectories. Clients who secure funding to turn side hustles into thriving businesses. Individuals who who resolve crushing IRS back tax debt. Entrepreneurs who optimize business structures saving tens of thousands annually.

- Solutions focused on financial transformation, not just maintenance

- Solutions that evolve over time, creating long-term benefit

- Comprehensive approaches that address root causes

- Long-term thinking that considers impacts on your family and future

- Commitment to outcomes that genuinely impact your financial future

How We Work

Your Journey From Financial Stress to Financial Success

We've guided thousands of individuals, entrepreneurs, and businesses from financial uncertainty to financial confidence. Here's exactly how we'll help you move forward:

1

Discovery and Assessment

Understanding Your Complete Financial Picture

We begin with deep discovery—understanding your immediate challenges, complete financial situation, and long-term goals.

Free 30-45 minute strategy session, comprehensive financial review, analysis of credit/tax/business finances, identification of opportunities, clear explanation of potential solutions

2

Strategy Development

Creating Your Integrated Financial Roadmap

Our team collaborates to design a comprehensive strategy where every element works together.

Internal team collaboration, integrated action plan development, timeline creation, and transparent pricing structure

3

Implementation and Execution

We Handle the Heavy Lifting While Keeping You Informed

Our specialists execute your strategy with precision while keeping you informed throughout.

System implementation, third-party communications, financial maintenance, lender connections regular progress updates, coordinated execution

4

Monitoring and Optimization

Continuous Improvement and Long-Term Partnership

We continuously monitor, adjust, and optimize as conditions change.

Regular performance reviews, proactive strategy adjustments, ongoing tax planning, continuous credit monitoring, strategic guidance, annual comprehensive reviews

Why Clients Choose Us

What Makes Steven Palmieri Different

The Integration Advantage

When your fractional CFO, tax strategist, and capital coordinator work under one roof, your business achieves higher Operating Leverage, revenue growth without proportional cost increases. We eliminate friction, ensuring tax planning fuels funding while growth triggers innovative savings. Everything compounds.

The Integrety Standard

We’ve made radical integrity our competitive advantage. You’ll know exactly why we suggest a strategy, what it costs, and the realistic outcomes. As your Sage, we believe in educational clarity. If a path isn't in your best interest, we tell you immediately, protecting your legacy with total honesty.

The Guardian Factor

Technical expertise is common. Finding partners who share the weight of your vision is rare. We measure success by the magnitude of life-changing transformation we create. As your Financial Guardians, we provide protective oversight, ensuring you never navigate high-stakes scaling alone. Deep expertise meets genuine care.

How We Help You

Our integrated services address every aspect of your financial wellness. Unlike traditional providers who specialize in one area, our team collaborates across financial disciplines including accounting, tax, funding, and credit repair to deliver more impactful results to you and your small business.

Business Financial Management

Strategic Accounting and CFO-Level Support

From basic bookkeeping to strategic CFO services that guide major decisions.

Monthly bookkeeping

Cash flow forecasting

Financial KPI tracking

Strategic planning

CFO-level advisory

Payroll set-up

Ideal for

Small to mid-size businesses

Startups scaling rapidly

Entrepreneurs needing strategic financial leadership

Tax Strategy and Resolution

Proactive Planning and Aggressive Problem-Solving

Minimize tax obligations through strategic planning while fiercely representing clients facing tax challenges.

Business and personal tax preparation

Year-round strategic tax planning

Entity structure consulting

IRS debt resolution

Offer in Compromise negotiations

Penalty abatement

Audit defense

Multi-state tax management

Ideal for

Businesses minimizing tax burden

Individuals facing tax debt

Entrepreneurs optimizing entity structures

Credit Optimization and Repair

Strategic Credit Building for Individuals and Businesses

Improve credit profiles through comprehensive strategies that address root causes while building sustainable credit health.

Credit report analysis

Dispute resolution

Strategic credit building

Business credit development

Debt-to-income optimization

Credit utilization strategy

Ideal for

Individuals rebuilding credit

Business preparing for funding

Entrepreneurs optimizing credit profile

Business Funding Access

Capital Solutions That Fuel Growth

Help businesses access capital while ensuring terms that support rather than endanger success.

Business lines of credit

Equipment financing

Working capital loans

SBA loan guidance

Commercial Real State financing

Credit optimization for better terms

Financial documentation preparation

Ideal for

Businesses seeking expansion capital

Startup needing initial funding

Entrepreneurs facing funding rejections

Business Debt Management and Restructuring

Strategic Solutions for Overwhelming Obligations

Negotiate favorable outcomes while protecting your interests and maintaining viable operations.

Business debt restructuring

Commercial debt settlement

Creditor negotiation

Payment plan establishment

Alternative exploration

Financial recovery planning

Ideal for

Business facing cashflow challenges

Business overwhelmed by debt

Entrepreneurs needing breathing room

Our team brings together decades of combined experience across credit restoration, tax strategy, legal protection, and business consulting.

Each advisor holds industry certifications and maintains ongoing education in their specialized fields, ensuring you receive guidance grounded in current regulations, proven methodologies, and cutting-edge financial strategies. We speak the language of finance fluently, from credit utilization ratios and debt-to-income calculations to tax code provisions and consumer protection statutes, so we can translate complex financial concepts into clear, actionable strategies for your situation.

Know the team

Our commitment

Ready to Scale Your Vision With Expert CFO Protection Every Step?

Your Financial Momentum Starts With One Conversation

You've carried the weight of your business long enough. Let us show you what's possible when expert fractional CFO leadership, innovative tax strategy, and proactive capital planning work together, all while a dedicated guardian watches over your interests. Your transformation begins with a strategy session where we'll assess your EBITDA, identify immediate risks, and show you a clear path forward. No pressure. No obligation. Just honest, high-level expertise and life-changing actionable insights.

Book Your Free Strategy Session

The CFO for Entrepreneurs

Where Strong Financial Strategy Meets Innovative Solutions—Delivered With Integrity to Create Life-Changing Results

For over 15 years, we've stood by businesses and individuals navigating their most critical financial challenges. We're not just consultants—we're your financial partner who genuinely cares about your success, combining deep expertise in accounting, tax strategy, and business funding to create comprehensive solutions that move your finances forward.

Founded on the belief that everyone deserves access to expert financial guidance delivered with complete transparency, we've helped thousands transform financial stress into financial confidence. Our integrated approach addresses the complete picture of your financial life—because credit, taxes, business finances, and funding don't exist in isolation, and neither should your solutions.

Book Your Free Strategy Session

Your Financial Advocate

Steven Palmieri is a recognized financial consultant, entrepreneur, and credit expert celebrated for delivering comprehensive financial solutions that genuinely change lives. With extensive experience spanning business finance, tax strategy, credit optimization, and entrepreneurial growth, Steven has built his reputation on one fundamental principle: financial expertise means nothing without genuine care for client outcomes.

Steven created an integrated ecosystem designed to address every aspect of financial wellness—from small business CFO-level support and tax planning optimization services to professional bookkeeping, personal and business tax preparation, credit repair services for individuals, business debt settlement and restructuring, and high-level financial strategy for entrepreneurs. Drawing on his deep background in business finance solutions,

Steven empowers clients to improve their credit scores, reduce tax liabilities strategically, and achieve long-term financial stability through innovative financial strategies delivered with unwavering integrity. Whether guiding clients through cash flow analysis for small businesses, implementing consumer credit improvement strategies, or delivering strategic CFO services for entrepreneurs,

Steven consistently demonstrates his dedication to helping others optimize their accounting processes and secure brighter financial futures. Steven didn't build his business just to offer financial services—he built it to change how financial solutions are delivered, creating an experience where clients feel genuinely cared for, completely informed, and consistently protected.

This personal commitment drives everything at Stevens Palmieri, and when you work with our team, you're benefiting from the culture of care, transparency, and excellence Steven has built into every aspect of its operations. Steven's work has transformed thousands of businesses and individuals—because behind every client is a person who finally sleeps peacefully, an entrepreneur who secured funding for their dream, a family that escaped crushing tax debt, or an individual who rebuilt credit they thought was permanently damaged.

Our Core Values

The Principles That Guide Everything We Do

Our values aren't just words—they're the foundation of every decision, every recommendation, and every relationship we build.

Strong

Bulletproof Solutions That Withstand Any Challenge

We don't offer quick fixes. Everything that we do is designed to provide sustainable relief to our clients. When we optimize your tax structure, it delivers benefits for years. When we improve your credit, we build sustainable habits. When we secure funding, we ensure terms that support growth.

- Financial solutions that deliver results even when conditions change

- Robust solutions backed by proven methodologies

- Unwavering commitment to your long-term success

Integrity

Complete Transparency in Every Interaction

You deserve to understand exactly what we're doing, why we're doing it, what it costs, and what realistic outcomes can look like. This commitment to integrity means sometimes having difficult conversations—but this honesty builds the trust that creates lasting success.

- No hidden fees—ever

- No unrealistic promises—if we can't deliver something, we tell you immediately

- No confusing jargon without clear explanations

- Honest timelines that account for real-world complexities

- Recommendations that serve your interests

Innovative

Cutting-Edge Solutions That Accelerate Your Success

We respect time-tested principles while constantly seeking innovative approaches that deliver better, faster results. We invest in advanced technology and forward-thinking strategies. Innovation without expertise is reckless. Expertise without innovation is stagnation. We give you both.

- Financial analysis that identifies hidden opportunities

- Real-time dashboards providing 24/7 financial visibility

- Advanced tax modeling showing exactly how strategies impact outcomes

- Relationships with traditional banks and innovative fintech lenders

- Proprietary credit optimization processes that accelerate credit score improvements

Life-Changing

Transformations That Reshape Your Financial Future

We're here to create fundamental transformations that reshape financial trajectories. Clients who secure funding to turn side hustles into thriving businesses. Individuals who who resolve crushing IRS back tax debt. Entrepreneurs who optimize business structures saving tens of thousands annually.

- Solutions focused on financial transformation, not just maintenance

- Solutions that evolve over time, creating long-term benefit

- Comprehensive approaches that address root causes

- Long-term thinking that considers impacts on your family and future

- Commitment to outcomes that genuinely impact your financial future

How We Work

Your Journey From Financial Stress to Financial Success

We've guided thousands of individuals, entrepreneurs, and businesses from financial uncertainty to financial confidence. Here's exactly how we'll help you move forward:

1

Discovery and Assessment

Understanding Your Complete Financial Picture

We begin with deep discovery—understanding your immediate challenges, complete financial situation, and long-term goals.

Free 30-45 minute strategy session, comprehensive financial review, analysis of credit/tax/business finances, identification of opportunities, clear explanation of potential solutions

2

Strategy Development

Creating Your Integrated Financial Roadmap

Our team collaborates to design a comprehensive strategy where every element works together.

Internal team collaboration, integrated action plan development, timeline creation, and transparent pricing structure

3

Implementation and Execution

We Handle the Heavy Lifting While Keeping You Informed

Our specialists execute your strategy with precision while keeping you informed throughout.

System implementation, third-party communications, financial maintenance, lender connections regular progress updates, coordinated execution

4

Monitoring and Optimization

Continuous Improvement and Long-Term Partnership

We continuously monitor, adjust, and optimize as conditions change.

Regular performance reviews, proactive strategy adjustments, ongoing tax planning, continuous credit monitoring, strategic guidance, annual comprehensive reviews

Why Clients Choose Us

What Makes Steven Palmieri Different

The Integration Advantage

When your fractional CFO, tax strategist, and capital coordinator work under one roof, your business achieves higher Operating Leverage, revenue growth without proportional cost increases. We eliminate friction, ensuring tax planning fuels funding while growth triggers innovative savings. Everything compounds.

The Integrety Standard

We’ve made radical integrity our competitive advantage. You’ll know exactly why we suggest a strategy, what it costs, and the realistic outcomes. As your Sage, we believe in educational clarity. If a path isn't in your best interest, we tell you immediately, protecting your legacy with total honesty.

The Guardian Factor

Technical expertise is common. Finding partners who share the weight of your vision is rare. We measure success by the magnitude of life-changing transformation we create. As your Financial Guardians, we provide protective oversight, ensuring you never navigate high-stakes scaling alone. Deep expertise meets genuine care.

How We Help You

Our integrated services address every aspect of your financial wellness. Unlike traditional providers who specialize in one area, our team collaborates across financial disciplines including accounting, tax, funding, and credit repair to deliver more impactful results to you and your small business.

Business Financial Management

Strategic Accounting and CFO-Level Support

From basic bookkeeping to strategic CFO services that guide major decisions.

Monthly bookkeeping

Cash flow forecasting

Financial KPI tracking

Strategic planning

CFO-level advisory

Payroll set-up

Ideal for

Small to mid-size businesses

Startups scaling rapidly

Entrepreneurs needing strategic financial leadership

Tax Strategy and Resolution

Proactive Planning and Aggressive Problem-Solving

Minimize tax obligations through strategic planning while fiercely representing clients facing tax challenges.

Business and personal tax preparation

Year-round strategic tax planning

Entity structure consulting

IRS debt resolution

Offer in Compromise negotiations

Penalty abatement

Audit defense

Multi-state tax management

Ideal for

Businesses minimizing tax burden

Individuals facing tax debt

Entrepreneurs optimizing entity structures

Credit Optimization and Repair

Strategic Credit Building for Individuals and Businesses

Improve credit profiles through comprehensive strategies that address root causes while building sustainable credit health.

Credit report analysis

Dispute resolution

Strategic credit building

Business credit development

Debt-to-income optimization

Credit utilization strategy

Ideal for

Individuals rebuilding credit

Business preparing for funding

Entrepreneurs optimizing credit profile

Business Funding Access

Capital Solutions That Fuel Growth

Help businesses access capital while ensuring terms that support rather than endanger success.

Business lines of credit

Equipment financing

Working capital loans

SBA loan guidance

Commercial Real State financing

Credit optimization for better terms

Financial documentation preparation

Ideal for

Businesses seeking expansion capital

Startup needing initial funding

Entrepreneurs facing funding rejections

Business Debt Management and Restructuring

Strategic Solutions for Overwhelming Obligations

Negotiate favorable outcomes while protecting your interests and maintaining viable operations.

Business debt restructuring

Commercial debt settlement

Creditor negotiation

Payment plan establishment

Alternative exploration

Financial recovery planning

Ideal for

Business facing cashflow challenges

Business overwhelmed by debt

Entrepreneurs needing breathing room

Our team brings together decades of combined experience across credit restoration, tax strategy, legal protection, and business consulting.

Each advisor holds industry certifications and maintains ongoing education in their specialized fields, ensuring you receive guidance grounded in current regulations, proven methodologies, and cutting-edge financial strategies. We speak the language of finance fluently, from credit utilization ratios and debt-to-income calculations to tax code provisions and consumer protection statutes, so we can translate complex financial concepts into clear, actionable strategies for your situation.

Know the team

Our commitment

Ready to Scale Your Vision With Expert CFO Protection Every Step?

Your Financial Momentum Starts With One Conversation

You've carried the weight of your business long enough. Let us show you what's possible when expert fractional CFO leadership, innovative tax strategy, and proactive capital planning work together, all while a dedicated guardian watches over your interests. Your transformation begins with a strategy session where we'll assess your EBITDA, identify immediate risks, and show you a clear path forward. No pressure. No obligation. Just honest, high-level expertise and life-changing actionable insights.

Book Your Free Strategy Session

The CFO for Entrepreneurs

Where Strong Financial Strategy Meets Innovative Solutions—Delivered With Integrity to Create Life-Changing Results

For over 15 years, we've stood by businesses and individuals navigating their most critical financial challenges. We're not just consultants—we're your financial partner who genuinely cares about your success, combining deep expertise in accounting, tax strategy, and business funding to create comprehensive solutions that move your finances forward.

Founded on the belief that everyone deserves access to expert financial guidance delivered with complete transparency, we've helped thousands transform financial stress into financial confidence. Our integrated approach addresses the complete picture of your financial life—because credit, taxes, business finances, and funding don't exist in isolation, and neither should your solutions.

Book Your Free Strategy Session

Your Financial Advocate

Steven Palmieri is a recognized financial consultant, entrepreneur, and credit expert celebrated for delivering comprehensive financial solutions that genuinely change lives. With extensive experience spanning business finance, tax strategy, credit optimization, and entrepreneurial growth, Steven has built his reputation on one fundamental principle: financial expertise means nothing without genuine care for client outcomes.

Steven created an integrated ecosystem designed to address every aspect of financial wellness—from small business CFO-level support and tax planning optimization services to professional bookkeeping, personal and business tax preparation, credit repair services for individuals, business debt settlement and restructuring, and high-level financial strategy for entrepreneurs. Drawing on his deep background in business finance solutions,

Steven empowers clients to improve their credit scores, reduce tax liabilities strategically, and achieve long-term financial stability through innovative financial strategies delivered with unwavering integrity. Whether guiding clients through cash flow analysis for small businesses, implementing consumer credit improvement strategies, or delivering strategic CFO services for entrepreneurs,

Steven consistently demonstrates his dedication to helping others optimize their accounting processes and secure brighter financial futures. Steven didn't build his business just to offer financial services—he built it to change how financial solutions are delivered, creating an experience where clients feel genuinely cared for, completely informed, and consistently protected.

This personal commitment drives everything at Stevens Palmieri, and when you work with our team, you're benefiting from the culture of care, transparency, and excellence Steven has built into every aspect of its operations. Steven's work has transformed thousands of businesses and individuals—because behind every client is a person who finally sleeps peacefully, an entrepreneur who secured funding for their dream, a family that escaped crushing tax debt, or an individual who rebuilt credit they thought was permanently damaged.

Our Core Values

The Principles That Guide Everything We Do

Our values aren't just words—they're the foundation of every decision, every recommendation, and every relationship we build.

Strong

Bulletproof Solutions That Withstand Any Challenge

We don't offer quick fixes. Everything that we do is designed to provide sustainable relief to our clients. When we optimize your tax structure, it delivers benefits for years. When we improve your credit, we build sustainable habits. When we secure funding, we ensure terms that support growth.

- Financial solutions that deliver results even when conditions change

- Robust solutions backed by proven methodologies

- Unwavering commitment to your long-term success

Integrity

Complete Transparency in Every Interaction

You deserve to understand exactly what we're doing, why we're doing it, what it costs, and what realistic outcomes can look like. This commitment to integrity means sometimes having difficult conversations—but this honesty builds the trust that creates lasting success.

- No hidden fees—ever

- No unrealistic promises—if we can't deliver something, we tell you immediately

- No confusing jargon without clear explanations

- Honest timelines that account for real-world complexities

- Recommendations that serve your interests

Innovative

Cutting-Edge Solutions That Accelerate Your Success

We respect time-tested principles while constantly seeking innovative approaches that deliver better, faster results. We invest in advanced technology and forward-thinking strategies. Innovation without expertise is reckless. Expertise without innovation is stagnation. We give you both.

- Financial analysis that identifies hidden opportunities

- Real-time dashboards providing 24/7 financial visibility

- Advanced tax modeling showing exactly how strategies impact outcomes

- Relationships with traditional banks and innovative fintech lenders

- Proprietary credit optimization processes that accelerate credit score improvements

Life-Changing

Transformations That Reshape Your Financial Future

We're here to create fundamental transformations that reshape financial trajectories. Clients who secure funding to turn side hustles into thriving businesses. Individuals who who resolve crushing IRS back tax debt. Entrepreneurs who optimize business structures saving tens of thousands annually.

- Solutions focused on financial transformation, not just maintenance

- Solutions that evolve over time, creating long-term benefit

- Comprehensive approaches that address root causes

- Long-term thinking that considers impacts on your family and future

- Commitment to outcomes that genuinely impact your financial future

How We Work

Your Journey From Financial Stress to Financial Success

We've guided thousands of individuals, entrepreneurs, and businesses from financial uncertainty to financial confidence. Here's exactly how we'll help you move forward:

1

Discovery and Assessment

Understanding Your Complete Financial Picture

We begin with deep discovery—understanding your immediate challenges, complete financial situation, and long-term goals.

Free 30-45 minute strategy session, comprehensive financial review, analysis of credit/tax/business finances, identification of opportunities, clear explanation of potential solutions

2

Strategy Development

Creating Your Integrated Financial Roadmap

Our team collaborates to design a comprehensive strategy where every element works together.

Internal team collaboration, integrated action plan development, timeline creation, and transparent pricing structure

3

Implementation and Execution

We Handle the Heavy Lifting While Keeping You Informed

Our specialists execute your strategy with precision while keeping you informed throughout.

System implementation, third-party communications, financial maintenance, lender connections regular progress updates, coordinated execution

4

Monitoring and Optimization

Continuous Improvement and Long-Term Partnership

We continuously monitor, adjust, and optimize as conditions change.

Regular performance reviews, proactive strategy adjustments, ongoing tax planning, continuous credit monitoring, strategic guidance, annual comprehensive reviews

Why Clients Choose Us

What Makes Steven Palmieri Different

The Integration Advantage

When your fractional CFO, tax strategist, and capital coordinator work under one roof, your business achieves higher Operating Leverage, revenue growth without proportional cost increases. We eliminate friction, ensuring tax planning fuels funding while growth triggers innovative savings. Everything compounds.

The Integrety Standard

We’ve made radical integrity our competitive advantage. You’ll know exactly why we suggest a strategy, what it costs, and the realistic outcomes. As your Sage, we believe in educational clarity. If a path isn't in your best interest, we tell you immediately, protecting your legacy with total honesty.

The Guardian Factor

Technical expertise is common. Finding partners who share the weight of your vision is rare. We measure success by the magnitude of life-changing transformation we create. As your Financial Guardians, we provide protective oversight, ensuring you never navigate high-stakes scaling alone. Deep expertise meets genuine care.

How We Help You

Our integrated services address every aspect of your financial wellness. Unlike traditional providers who specialize in one area, our team collaborates across financial disciplines including accounting, tax, funding, and credit repair to deliver more impactful results to you and your small business.

Business Financial Management

Strategic Accounting and CFO-Level Support

From basic bookkeeping to strategic CFO services that guide major decisions.

Monthly bookkeeping

Cash flow forecasting

Financial KPI tracking

Strategic planning

CFO-level advisory

Payroll set-up

Ideal for

Small to mid-size businesses

Startups scaling rapidly

Entrepreneurs needing strategic financial leadership

Tax Strategy and Resolution

Proactive Planning and Aggressive Problem-Solving

Minimize tax obligations through strategic planning while fiercely representing clients facing tax challenges.

Business and personal tax preparation

Year-round strategic tax planning

Entity structure consulting

IRS debt resolution

Offer in Compromise negotiations

Penalty abatement

Audit defense

Multi-state tax management

Ideal for

Businesses minimizing tax burden

Individuals facing tax debt

Entrepreneurs optimizing entity structures

Credit Optimization and Repair

Strategic Credit Building for Individuals and Businesses

Improve credit profiles through comprehensive strategies that address root causes while building sustainable credit health.

Credit report analysis

Dispute resolution

Strategic credit building

Business credit development

Debt-to-income optimization

Credit utilization strategy

Ideal for

Individuals rebuilding credit

Business preparing for funding

Entrepreneurs optimizing credit profile

Business Funding Access

Capital Solutions That Fuel Growth

Help businesses access capital while ensuring terms that support rather than endanger success.

Business lines of credit

Equipment financing

Working capital loans

SBA loan guidance

Commercial Real State financing

Credit optimization for better terms

Financial documentation preparation

Ideal for

Businesses seeking expansion capital

Startup needing initial funding

Entrepreneurs facing funding rejections

Business Debt Management and Restructuring

Strategic Solutions for Overwhelming Obligations

Negotiate favorable outcomes while protecting your interests and maintaining viable operations.

Business debt restructuring

Commercial debt settlement

Creditor negotiation

Payment plan establishment

Alternative exploration

Financial recovery planning

Ideal for

Business facing cashflow challenges

Business overwhelmed by debt

Entrepreneurs needing breathing room

Our team brings together decades of combined experience across credit restoration, tax strategy, legal protection, and business consulting.

Each advisor holds industry certifications and maintains ongoing education in their specialized fields, ensuring you receive guidance grounded in current regulations, proven methodologies, and cutting-edge financial strategies. We speak the language of finance fluently, from credit utilization ratios and debt-to-income calculations to tax code provisions and consumer protection statutes, so we can translate complex financial concepts into clear, actionable strategies for your situation.

Know the team

Our commitment

Ready to Scale Your Vision With Expert CFO Protection Every Step?

Your Financial Momentum Starts With One Conversation

You've carried the weight of your business long enough. Let us show you what's possible when expert fractional CFO leadership, innovative tax strategy, and proactive capital planning work together, all while a dedicated guardian watches over your interests. Your transformation begins with a strategy session where we'll assess your EBITDA, identify immediate risks, and show you a clear path forward. No pressure. No obligation. Just honest, high-level expertise and life-changing actionable insights.

Book Your Free Strategy Session

The CFO for Entrepreneurs

Where Strong Financial Strategy Meets Innovative Solutions—Delivered With Integrity to Create Life-Changing Results

For over 15 years, we've stood by businesses and individuals navigating their most critical financial challenges. We're not just consultants—we're your financial partner who genuinely cares about your success, combining deep expertise in accounting, tax strategy, and business funding to create comprehensive solutions that move your finances forward.

Founded on the belief that everyone deserves access to expert financial guidance delivered with complete transparency, we've helped thousands transform financial stress into financial confidence. Our integrated approach addresses the complete picture of your financial life—because credit, taxes, business finances, and funding don't exist in isolation, and neither should your solutions.

Book Your Free Strategy Session

Your Financial Advocate

Steven Palmieri is a recognized financial consultant, entrepreneur, and credit expert celebrated for delivering comprehensive financial solutions that genuinely change lives. With extensive experience spanning business finance, tax strategy, credit optimization, and entrepreneurial growth, Steven has built his reputation on one fundamental principle: financial expertise means nothing without genuine care for client outcomes.

Steven created an integrated ecosystem designed to address every aspect of financial wellness—from small business CFO-level support and tax planning optimization services to professional bookkeeping, personal and business tax preparation, credit repair services for individuals, business debt settlement and restructuring, and high-level financial strategy for entrepreneurs. Drawing on his deep background in business finance solutions,

Steven empowers clients to improve their credit scores, reduce tax liabilities strategically, and achieve long-term financial stability through innovative financial strategies delivered with unwavering integrity. Whether guiding clients through cash flow analysis for small businesses, implementing consumer credit improvement strategies, or delivering strategic CFO services for entrepreneurs,

Steven consistently demonstrates his dedication to helping others optimize their accounting processes and secure brighter financial futures. Steven didn't build his business just to offer financial services—he built it to change how financial solutions are delivered, creating an experience where clients feel genuinely cared for, completely informed, and consistently protected.

This personal commitment drives everything at Stevens Palmieri, and when you work with our team, you're benefiting from the culture of care, transparency, and excellence Steven has built into every aspect of its operations. Steven's work has transformed thousands of businesses and individuals—because behind every client is a person who finally sleeps peacefully, an entrepreneur who secured funding for their dream, a family that escaped crushing tax debt, or an individual who rebuilt credit they thought was permanently damaged.

Our Core Values

The Principles That Guide Everything We Do

Our values aren't just words—they're the foundation of every decision, every recommendation, and every relationship we build.

Strong

Bulletproof Solutions That Withstand Any Challenge

We don't offer quick fixes. Everything that we do is designed to provide sustainable relief to our clients. When we optimize your tax structure, it delivers benefits for years. When we improve your credit, we build sustainable habits. When we secure funding, we ensure terms that support growth.

- Financial solutions that deliver results even when conditions change

- Robust solutions backed by proven methodologies

- Unwavering commitment to your long-term success

Integrity

Complete Transparency in Every Interaction

You deserve to understand exactly what we're doing, why we're doing it, what it costs, and what realistic outcomes can look like. This commitment to integrity means sometimes having difficult conversations—but this honesty builds the trust that creates lasting success.

- No hidden fees—ever

- No unrealistic promises—if we can't deliver something, we tell you immediately

- No confusing jargon without clear explanations

- Honest timelines that account for real-world complexities

- Recommendations that serve your interests

Innovative

Cutting-Edge Solutions That Accelerate Your Success

We respect time-tested principles while constantly seeking innovative approaches that deliver better, faster results. We invest in advanced technology and forward-thinking strategies. Innovation without expertise is reckless. Expertise without innovation is stagnation. We give you both.

- Financial analysis that identifies hidden opportunities

- Real-time dashboards providing 24/7 financial visibility

- Advanced tax modeling showing exactly how strategies impact outcomes

- Relationships with traditional banks and innovative fintech lenders

- Proprietary credit optimization processes that accelerate credit score improvements

Life-Changing

Transformations That Reshape Your Financial Future

We're here to create fundamental transformations that reshape financial trajectories. Clients who secure funding to turn side hustles into thriving businesses. Individuals who who resolve crushing IRS back tax debt. Entrepreneurs who optimize business structures saving tens of thousands annually.

- Solutions focused on financial transformation, not just maintenance

- Solutions that evolve over time, creating long-term benefit

- Comprehensive approaches that address root causes

- Long-term thinking that considers impacts on your family and future

- Commitment to outcomes that genuinely impact your financial future

How We Work

Your Journey From Financial Stress to Financial Success

We've guided thousands of individuals, entrepreneurs, and businesses from financial uncertainty to financial confidence. Here's exactly how we'll help you move forward:

1

Discovery and Assessment

Understanding Your Complete Financial Picture

We begin with deep discovery—understanding your immediate challenges, complete financial situation, and long-term goals.

Free 30-45 minute strategy session, comprehensive financial review, analysis of credit/tax/business finances, identification of opportunities, clear explanation of potential solutions

2

Strategy Development

Creating Your Integrated Financial Roadmap

Our team collaborates to design a comprehensive strategy where every element works together.

Internal team collaboration, integrated action plan development, timeline creation, and transparent pricing structure

3

Implementation and Execution

We Handle the Heavy Lifting While Keeping You Informed

Our specialists execute your strategy with precision while keeping you informed throughout.

System implementation, third-party communications, financial maintenance, lender connections regular progress updates, coordinated execution

4

Monitoring and Optimization

Continuous Improvement and Long-Term Partnership

We continuously monitor, adjust, and optimize as conditions change.

Regular performance reviews, proactive strategy adjustments, ongoing tax planning, continuous credit monitoring, strategic guidance, annual comprehensive reviews

Why Clients Choose Us

What Makes Steven Palmieri Different

The Integration Advantage

When your fractional CFO, tax strategist, and capital coordinator work under one roof, your business achieves higher Operating Leverage, revenue growth without proportional cost increases. We eliminate friction, ensuring tax planning fuels funding while growth triggers innovative savings. Everything compounds.

The Integrety Standard

We’ve made radical integrity our competitive advantage. You’ll know exactly why we suggest a strategy, what it costs, and the realistic outcomes. As your Sage, we believe in educational clarity. If a path isn't in your best interest, we tell you immediately, protecting your legacy with total honesty.

The Guardian Factor

Technical expertise is common. Finding partners who share the weight of your vision is rare. We measure success by the magnitude of life-changing transformation we create. As your Financial Guardians, we provide protective oversight, ensuring you never navigate high-stakes scaling alone. Deep expertise meets genuine care.

How We Help You

Our integrated services address every aspect of your financial wellness. Unlike traditional providers who specialize in one area, our team collaborates across financial disciplines including accounting, tax, funding, and credit repair to deliver more impactful results to you and your small business.

Business Financial Management

Strategic Accounting and CFO-Level Support

From basic bookkeeping to strategic CFO services that guide major decisions.

Monthly bookkeeping

Cash flow forecasting

Financial KPI tracking

Strategic planning

CFO-level advisory

Payroll set-up

Ideal for

Small to mid-size businesses

Startups scaling rapidly

Entrepreneurs needing strategic financial leadership

Tax Strategy and Resolution

Proactive Planning and Aggressive Problem-Solving

Minimize tax obligations through strategic planning while fiercely representing clients facing tax challenges.

Business and personal tax preparation

Year-round strategic tax planning

Entity structure consulting

IRS debt resolution

Offer in Compromise negotiations

Penalty abatement

Audit defense

Multi-state tax management

Ideal for

Businesses minimizing tax burden

Individuals facing tax debt

Entrepreneurs optimizing entity structures

Credit Optimization and Repair

Strategic Credit Building for Individuals and Businesses

Improve credit profiles through comprehensive strategies that address root causes while building sustainable credit health.

Credit report analysis

Dispute resolution

Strategic credit building

Business credit development

Debt-to-income optimization

Credit utilization strategy

Ideal for

Individuals rebuilding credit

Business preparing for funding

Entrepreneurs optimizing credit profile

Business Funding Access

Capital Solutions That Fuel Growth

Help businesses access capital while ensuring terms that support rather than endanger success.

Business lines of credit

Equipment financing

Working capital loans

SBA loan guidance

Commercial Real State financing

Credit optimization for better terms

Financial documentation preparation

Ideal for

Businesses seeking expansion capital

Startup needing initial funding

Entrepreneurs facing funding rejections

Business Debt Management and Restructuring

Strategic Solutions for Overwhelming Obligations

Negotiate favorable outcomes while protecting your interests and maintaining viable operations.

Business debt restructuring

Commercial debt settlement

Creditor negotiation

Payment plan establishment

Alternative exploration

Financial recovery planning

Ideal for

Business facing cashflow challenges

Business overwhelmed by debt

Entrepreneurs needing breathing room

Our team brings together decades of combined experience across credit restoration, tax strategy, legal protection, and business consulting.

Each advisor holds industry certifications and maintains ongoing education in their specialized fields, ensuring you receive guidance grounded in current regulations, proven methodologies, and cutting-edge financial strategies. We speak the language of finance fluently, from credit utilization ratios and debt-to-income calculations to tax code provisions and consumer protection statutes, so we can translate complex financial concepts into clear, actionable strategies for your situation.

Know the team

Our commitment

Ready to Scale Your Vision With Expert CFO Protection Every Step?

Your Financial Momentum Starts With One Conversation

You've carried the weight of your business long enough. Let us show you what's possible when expert fractional CFO leadership, innovative tax strategy, and proactive capital planning work together, all while a dedicated guardian watches over your interests. Your transformation begins with a strategy session where we'll assess your EBITDA, identify immediate risks, and show you a clear path forward. No pressure. No obligation. Just honest, high-level expertise and life-changing actionable insights.

Book Your Free Strategy Session